5 Things You Should Know About Neobanking

November 8th, 2019 | By Jscrambler | 4 min read

You might not be entirely familiar with the term neobanking. While it's still not a universally adopted denomination, it describes a sub-industry of Banking that can't simply be described as "Digital Banking".

Neobanks are 100% digital, with no physical branches or face-to-face interaction. Instead, they operate solely through digital channels and provide their services through Web and mobile applications.

There's much to be said about these players that challenge traditional banks. So, let's explore five facts about Neobanks.

1. Neobanks are growing fast

Neobanks have registered impressive growth in the last few years.

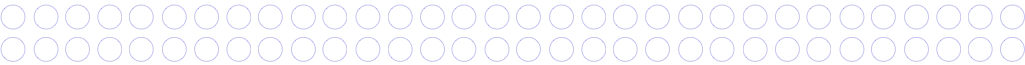

As of August 2019, they had cumulatively amassed over 30 million customers. This figure excludes highly populated markets like China and India. Some estimates predict that UK-based challenger banks will grow threefold within 12 months, hitting the 35 million user mark.

Even among other Fintechs, Neobanks make up the fastest-growing segment. This growth is vastly fueled by aggressive investments in Neobanks, with several "unicorn" funding rounds and a combined $2.5 billion investment in 2019.

South America is displaying an especially interesting number of rapidly growing Neobanking start-ups, with Mexico alone quickly becoming a new "battleground" for challenger banks.

2. Their IT infrastructure is a competitive advantage

According to some banking industry analyses, traditional banks spend 70% of their IT budget on maintaining legacy systems. On the contrary, by not having to rely on these legacy systems, Neobanks experience servicing costs that can be up to 70% lower than those of incumbents.

Neobanks' IT approach relies on microservices and standardized APIs for the back end while leveraging open-source front-end frameworks like React Native and Ionic to develop modern web and mobile apps.

By betting on these front-end frameworks and third-party JavaScript libraries and scripts to build modular applications, Neobanks enjoys fast product development at lower costs. This, in turn, enables them to rapidly launch new features and update existing ones according to customers' feedback.

3 . Neobanking apps are feature-packed and perform much better

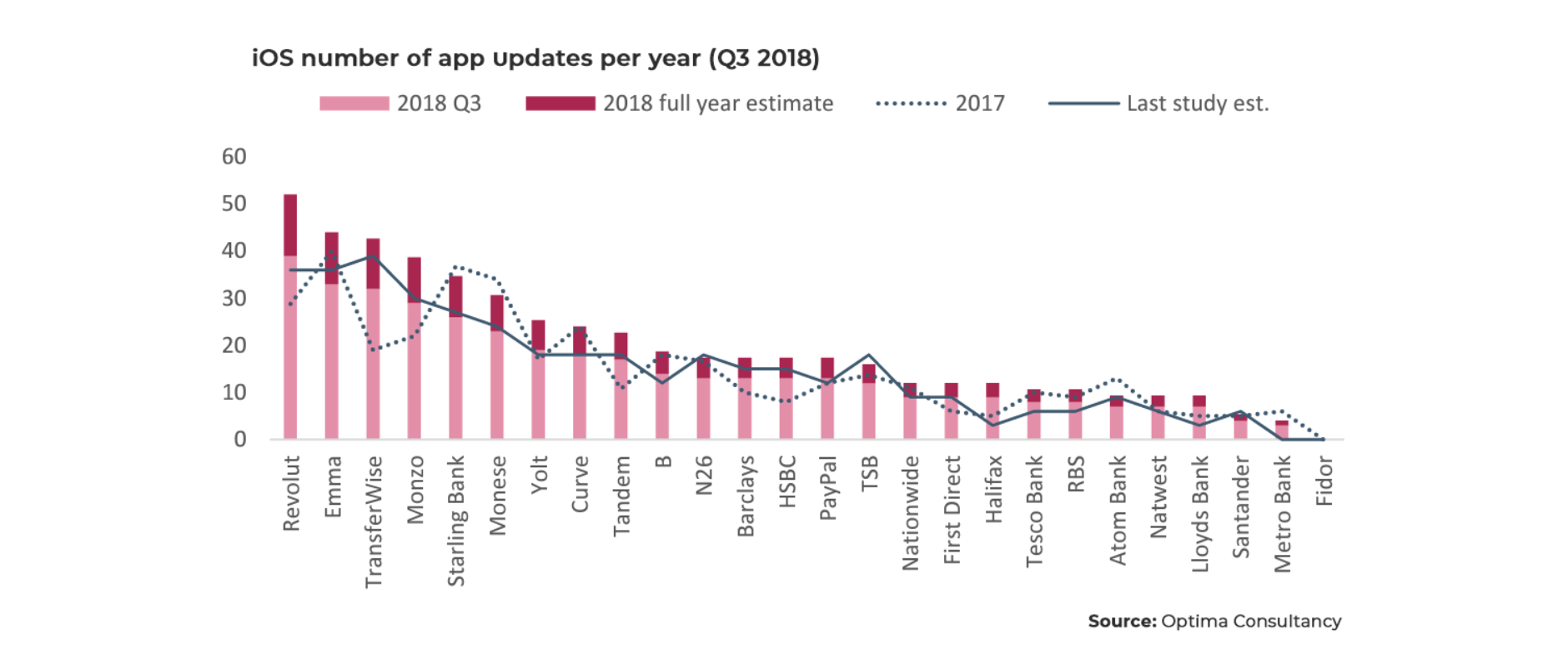

As mentioned above, because Neobanks rely on peer-reviewed JavaScript frameworks and libraries, they reduce time to market and iterate quickly.

A 2018 market analysis shows that, on average, Neobanking apps are adding ten new features per year, compared to six in traditional banks. This includes 27 app updates per year, while incumbents average under 10. Another aspect of mobile apps is their performance, as users are more demanding than ever about loading times and overall performance. The same 2018 study found that Neobanking apps present a better user experience across the board, performing 42% faster than traditional banking apps.

Another aspect of mobile apps is their performance, as users are more demanding than ever about loading times and overall performance. The same 2018 study found that Neobanking apps present a better user experience across the board, performing 42% faster than traditional banking apps.

4. Consumers are happier with Neobanks than with incumbents

Neobanking is fueled by hefty investment rounds. But while one of their KPIs is the number of customers, they can't afford to stop at customer acquisition. Instead, customer retention is a concern for business sustainability.

To Neobanks, the customer is everything. That's why so many definitions name them "customer-centric" banks: all their actions are based on customer needs, wants, and continuous feedback.

This customer focus is, unsurprisingly, producing results. Recent surveys in the U.S. point out that 90% of consumers in the U.S. are satisfied with Neobanks, while the figure is only 66% for the top 50 global banks.

5. Neobanks need to address security to unlock customer trust

Amidst their need to quickly launch product updates to exceed customer expectations, Neobanks often has to prioritize development speed over security. As a result, two security gaps appear: exposed client-side JavaScript and client-side data breaches.

The threat of exposed JavaScript happens because Neobanks places logic on the client side. While it is ill-advised to do so, they often have no choice because storing all JavaScript on the server would mean performance drops and a hit to the user experience. To mitigate this problem, Neobanks must employ enterprise-grade JavaScript protection, preventing code reverse engineering, debugging, and tampering.

As for client-side data breaches, Neobanks are especially at risk since they integrate external code, mostly npm packages and third-party scripts. Both are gateways for attackers to breach Neobanks without touching their servers.

Instead, by going after Neobank's smaller, less secure third-party providers, attackers can launch a web supply chain attack and steal valuable financial and personal data.

Mainstream security approaches, such as using a Web Application Firewall (WAF), fall short of preventing these attacks. To address this threat, Neobanks must gain client-side visibility with a webpage monitoring solution to detect and stop these attacks in real time and keep their users safe.

Conclusion

Neobanks are bringing a new force to the Banking sector. They challenge traditional banks by delivering highly engaging digital banking experiences and are quickly amassing users all across the globe.

But guaranteeing a fantastic user experience isn't enough.

Neobanks still have to gain the consumer's trust in a market where security is everything.

Hence, Nebonks rely on cutting-edge security technology to secure their apps and users' data. Ultimately, Neobanks will likely redefine the paradigm of banking.

If you're interested in how Jscrambler is helping Neobanks secure their apps and users, explore our enterprise plans and talk to us!

Jscrambler

The leader in client-side Web security. With Jscrambler, JavaScript applications become self-defensive and capable of detecting and blocking client-side attacks like Magecart.

View All ArticlesMust read next

[Case Study] Jscrambler Helps Neobanks Protect JavaScript

In this post, we will explore a case study on how Jscrambler has helped Neobanks protect their JavaScript and overcome some common challenges in their industry.

June 9, 2021 | By Jscrambler | 5 min read

Online Banking and Financial Services: Is Enough Being Done to Protect the End-User?

Working in online banking and financial services? Check what you should address to protect your users according to Information Age.

August 16, 2017 | By Jscrambler | 5 min read